How to reverse the ‘urban doom loop’

Walkable urban places (WalkUPs) have been declining since 2019 due to the pandemic, rising disorder (or its perception), and a shrinking office market—but a new nationwide report says a virtuous cycle can be restored by rebalancing real estate and uses.

Reiminaging Cities: Disrupting the Urban Doom Loop, written by Cushman & Wakefield with Christopher Leinberger and Places Platform, analyzes 208 regionally significant urban centers in 15 major metro areas across the US. These include four types of WalkUPs: downtowns, downtown adjacent, urban commercial, and urban universities.

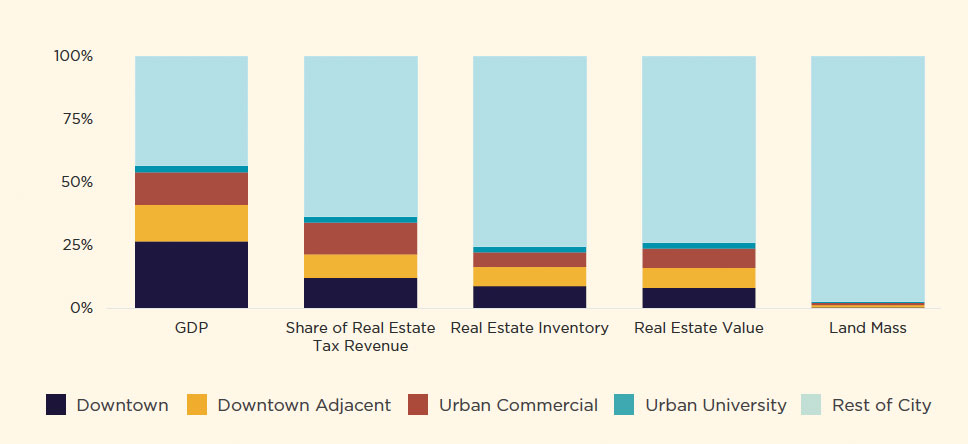

These walkable centers are efficient economic engines: They comprise only 3 percent of the land but generate 57 percent of the GDP in these cities. “One could argue that these WalkUPs are the reason the city exists,” says Leinberger, a pre-eminent researcher on downtowns and urban centers. Better functioning WalkUPs would improve the nation’s economy, the report argues.

The “doom loop” results from WalkUPs putting “too many eggs in the office basket.” Using portfolio theory to rebalance real estate toward less office space (work), more play (culture, entertainment, retail), and more residential (especially for-sale housing) would shift these urban centers back to the positive economic track they were on prior to COVID, the report concludes.

“The bottom line is that many of these WalkUPs are in an urban doom loop, a downward spiral, of lower office occupancy driving lower rents, lower valuation and lower property taxes, decreased services, increased crime, etc. The reason for the doom loop is that these WalkUPs violated portfolio theory,” he explains.

As Leinberger says: “The key recommendations include reducing the office share of the portfolio (especially Downtown), increase the residential share (especially Downtown), increasing the for-sale housing in all WalkUPs and, most unexpected, increase the various components of ‘play’ in all WalkUPs. This reflects the emerging ‘experience’ economy layering on top of the existing ‘knowledge’ economy.”

The research is based upon a unique, holistic data set comprising 100 percent of the real estate in these 208 WalkUPs; office, industrial, rental multifamily, for-sale housing, destination and local retail, owner-user space (corporate, nonprofit, government, etc.), urban entertainment, convention centers, hotels, museums, professional sports venues, reports Leinberger.

The findings are especially relevant to New Urbanism because WalkUPs are defined by their physical characteristics: walkability, connectivity, great streets, inclusivity, and a mix of live, work, and play—in addition to their regionally significant commercial real estate development.

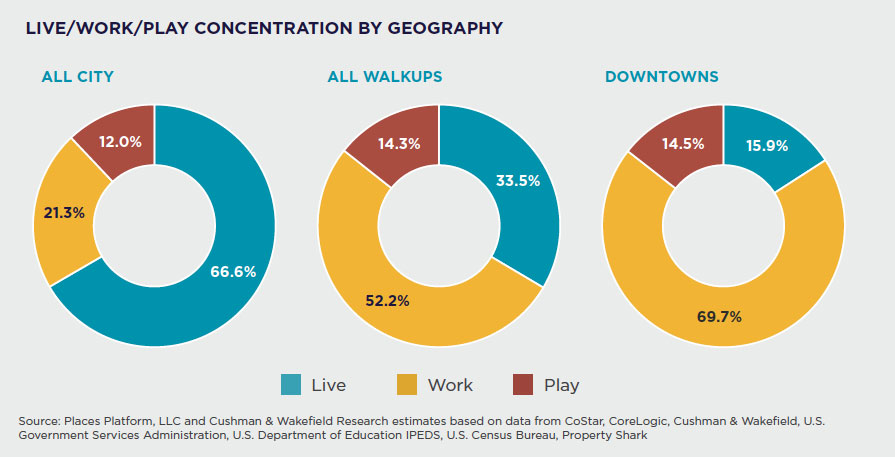

The play component—sports, entertainment, museums, theaters, retail, restaurants, convention centers, hotels, and more—comprises only 14 percent of the real estate in WalkUPs. The optimum range is 17-31 percent, with a mean goal of 26 percent. That’s nearly double the current level. One surprising finding that helps to explain the importance of “play” is that nearly 70 percent of foot traffic in urban centers is visitors; they neither work nor live in the WalkUP. This foot traffic contributes to safe and attractive streets and helps drive the economy of urban centers. This is true, surprisingly, not just in downtowns but the other kinds of WalkUPs.

Residential is under-represented downtown, comprising only 16 percent of real estate—the number should be closer to 32 percent—a range of 23-47 percent is healthy depending on local conditions, Reimagining Cities finds. However, it is possible to have too much residential space. Work should still be a plurality of real estate in WalkUPs, centering around 42 percent (it now averages 52 percent in all WalkUPs and 70 percent downtown). While office space gets a bad rap and is over-represented downtown, it is still needed—and WalkUPs are the most logical place for it to be built, Reimagining Cities argues.

The “knowledge economy” focuses on WalkUPs: whether it be in Silicon Alley in Manhattan, the US Naval Research Laboratory in the Downtown Adjacent Capitol Riverfront WalkUP in Washington, DC, or South Lake Union (Downtown Adjacent to Downtown Seattle), home to Amazon’s headquarters. Tech companies sometimes build their own WalkUPs. “Microsoft in the 1980s started in a business park in Redmond, par for the course in that decade, but has been engaging in the ‘urbanization of the suburbs’ today in the suburban Redmond Town Center WalkUP,” the report explains.

The “experience economy” also centers on WalkUPs. “It is estimated that 64% of tourism is referred to as ‘urban tourism,’ most of which takes place in WalkUPs,” the authors write.

The “doom loop” in the title may be overly dramatic. This decline has mainly taken place in downtown WalkUPs, and this is mostly due to the decline in the office market. The report distinguishes between a “structural doom loop,” such as the one that gripped cities from the 1950s through the 1980s, and an “episodic doom loop” caused by disasters, public health crises, and political and civil unrest. The one we are in now is episodic, they claim.

The report is full of interesting statements and findings:

- The major development trend in the next 20 years will be “urbanization of the suburbs,” or bringing the benefits of WalkUPs to wider parts of metro areas.

- The economic power of WalkUPs is explained by “agglomeration theory,” or the benefits of concentrations of economic, social, cultural, sports, and residential activity. Examples include restaurants near residential units or sports and event arenas near office parking so that they can share facilities.

- Business improvement districts and similar organizations funded by real estate tax surcharges did not yield clear real estate performance advantages, especially outside of downtown. “Surprising to me, place management organizations, which were in a third of the 208 WalkUPs, had mixed economic and fiscal performance versus the WalkUPs without place management—a troubling conclusion," reports Leinberger.

- Philanthropic and private sector support is often important in revitalizing WalkUPs. Downtown Detroit's turnaround was spurred by GM headquarters relocation in 2000, followed by Rock Ventures (subsidiary of Rocket Mortgage) relocating Rocket Mortgage’s headquarters Downtown, and the company buying over 100 buildings—led by founder Dan Gilbert.

The report also makes the case for regulatory reform, especially by-right form-based coding. It states:

- While we are not recommending getting rid of planning departments, “making the right thing easy” can hasten the transition of the portfolio, which we estimate will yield benefits for both the local economy and governmental revenues.

- Form-based codes are one way to allow for greater flexibility in future building uses as market conditions change. If most of today’s offices were built using form-based codes, the conversion from office to residential (or other desirable uses) would be far more feasible.

- Expedited building permitting is another path. Many supply-constrained jurisdictions across the country require years to obtain building permits, even if the by-right zoning is in place.

- Incentives matter. Some cities (or states) may find that tax abatements and/or subsidies provide an accelerant to private sector led redevelopment. These options can be considered “carrots,” while a form of “stick” might be a land tax scheme. Any additional federal incentives may further facilitate a faster rebalancing.

Read the entire report here