Finance

When you see news about the infrastructure around us, remember your own personal budget: how would you wisely spend your resources of time and money?

Note: This article first appeared on Strong Towns. Public Square editor Robert Steuteville is on leave through the last week of October.

Charles Marohn's new book presents a way out for American cities that are trapped in a vicious cycle: Build neighborhoods one small step at a time rather than going straight to utopia.

Opportunity Zone finance is helping to kickstart development around an underutilized section of the Beltline in Atlanta.

We've seen how Opportunity Zones can spur multiple developments to provide high-quality low-income housing while transforming communities.

Walkable urban plans in small and mid-sized cities and suburbs are more likely to be financed if the city is prepared.

Walkable mixed-use neighborhoods help families build wealth—enough to help fund big-ticket items like college and retirement.

After many decades of financial bias in favor of single-use buildings, the pendulum has begun to move back toward mixed-use and its superior convenience.

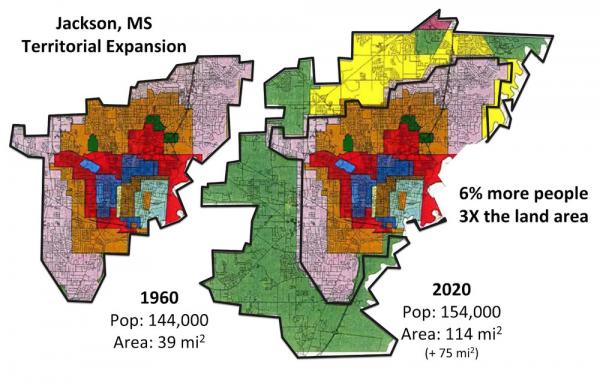

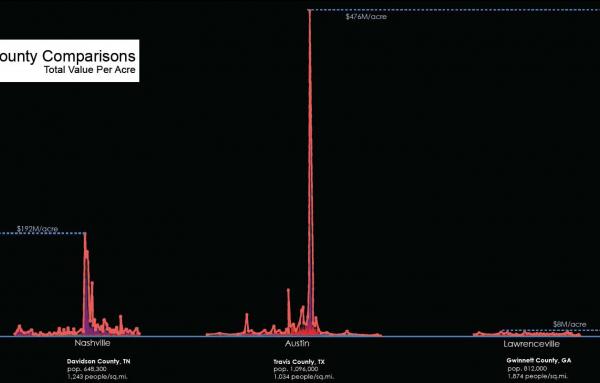

Charles Marohn of Strong Towns and Joe Minicozzi of Urban3 have been sounding the alarm across America about the financial unsustainability of fragmented development patterns and conventional suburban infrastructure.

Affordable housing is built in the suburbs in automobile-dependent places, forcing low-income and working-class residents to spend too much on transportation.

Mixed-use, walkable commercial development is outpacing large-scale conventional suburban construction in every major metro area, according to the new report Foot Traffic Ahead: Ranking Walkable Urbanism in America’s Largest Metros, 2016.

...

Federal programs that were created in another era continue to pose barriers to financing mixed-use, compact, sustainable communities—despite lower risk.